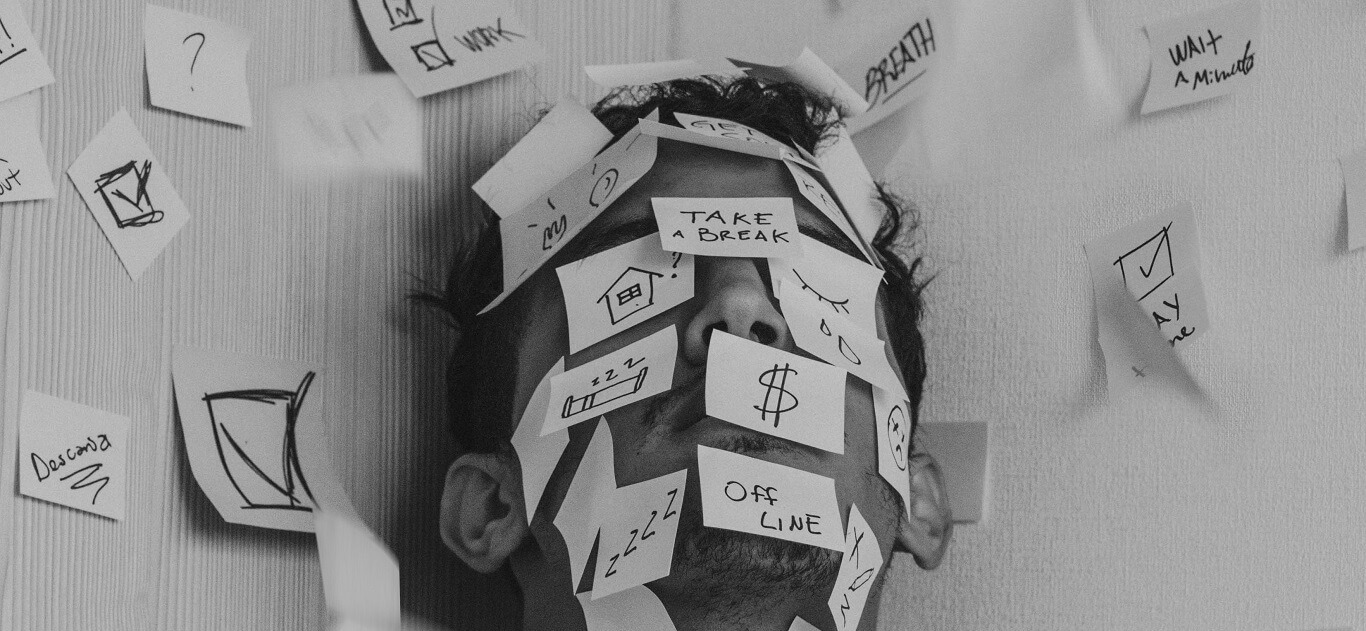

There is no doubt that the disruption & uncertainty caused by Covid has triggered enormous financial stress to many people.

Landlords and Business owners are seeing their investments evaporate in front of their eyes. Unexpected lockdowns and border closures have made it hard to plan ahead and as a consequence, people have become hesitant towards spending money.

The share market may have recovered but that only tells a small part of the larger economic story.

If you are feeling stressed by this situation, you are not alone and it’s perfectly normal.

What can you do about it?

- If your stress is overwhelming, seek medical help.

If you cannot function adequately (can’t sleep, eat or work productively) then you should consult your GP or a medical professional for help towards getting these symptoms under control. Hopefully, we are going to a place where the stigma of mental health is less of a barrier to people getting the help that they need.

If you need to let your emotions out, do that safely and then comfort yourself so that you can reset back to a clear-minded state of being.

- Spend some time assessing the causes of your stress.

For many, it could be that their income has gone down and the resulting inability to repay debts. A simple assessment of the main problems you are facing can bring clarity.

It’s easy to feel down when times are tough and it is normal to project that low point forward. These projections make it seem like the bad times will last forever.

Times are tough right now, but it is likely that in 1-2 years’ time when we are clear of this crisis there will be an entertainment & tourism boom. That will then flow through the economy.

A good question to ask yourself is: can you survive until we get to the recovery phase?

If you can’t survive then it is better to take early action than wait passively until the end. Business failure is not good but when the economic environment deteriorates unexpectedly it can’t be helped. Don’t beat yourself up for taking risks that in hindsight were unacceptable. We have all been there.

While I am all for taking a long-term view, sometimes you need to just focus on getting through the day/week/month and consciously squash down the worries that stem from what might go wrong next year or in the longer term.

- Take some concrete actions to improve your situation

The types of financial actions that might help are:

- Selling assets.

- Find ways to cut back on spending commitments.

- Pay down, re-structure or re-finance debts.

- Obtain a Covid loan from your bank

- Find money from wherever you can

- Talk to a business broker about the possibility of selling your business

Even assets that are unprofitable, can still be sold to someone who might be able to make better use of them.

- Talk to people that can help you

The best people to talk to are:

- Financial Counsellors

- Your Bank about your loans with them

- The ATO about your tax debts

- Other creditors (e.g. insurance, utilities, etc.)

- Your Accountant

- Your mortgage broker

- Make a plan for the future

Once you have your current situation under control, it makes sense to then focus more on what the future holds.

Alternately, knowing that you will be ok in the future can alleviate the stress of dealing with a difficult present.

The sale of business/property, inheritances and retirement benefits can make a big difference to future financial security.

We can help you to write a Financial Plan that works for you.