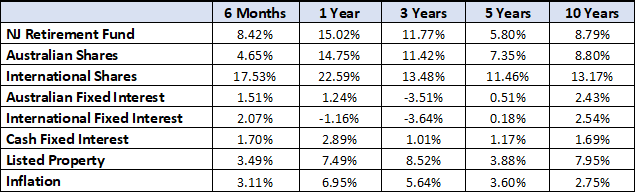

Market returns to 30 June 2023

All Ordinaries Index

Market Commentary

The Australian Sharemarket fell sharply 3 times during the last 12 months but the overall performance for the year was very good.

Investment markets are always unpredictable and volatility has been high in the last few months. It’s not easy for investors but patience will be rewarded in the long run.

Inflation

The rate of inflation was 3.5% for the calendar year 2021 and 7.8% for the calendar year 2022. In May (the most recent result) it was 5.6% which is a reduction but still well above the target level of 2-3%.

The Reserve bank increased the cash interest rate by 0.25% in May and June to 4.10% then held at that level in July. They have indicated that rates could increase again in future. Increases in interest rates are generally bad for investment markets but there is a feeling that we are getting close to the top of the current interest rate cycle.

Geopolitical instability

The Russian “Special Military Operation” phase of the war in Ukraine has now been going for more than 16 months. Millions of people have been displaced with casualties exceeding 300,000. It seems likely that this war will continue indefinitely.

Both sides are stuck in stalemate with WWI style trench warfare along a huge front. The allies have promised to supply F16 fighters to Ukraine and Russian troop morale is supposedly close to cracking but any breakthroughs seem far off.

New Government

It has now been 12 months since the Albanese Labor government was elected. There has been little tangible change to government policies during that time but an intangible sense that a change in government was necessary.

The government is facing a housing crisis along with the general cost of living pressures. These problems are not easily solved so cracks are starting to emerge and expectations are increasing.

The only note of optimism is that the Federal budget might finally return to surplus for the first time in 15 years. This is due to the strong economic recovery coming out of Covid lockdowns rather than any specific economic policies undertaken by the government though.

China

One positive outcome from the change of government has been a reset in our relationship with our largest trading partner. This relationship is never going back to where it was 10 years ago however we are a reliable supplier of commodities that China needs including Iron Ore and Coal.

Our problem is that their economy is going down which is bad for us.

Recent economic statistics from China included:

- Youth unemployment 20.4%

- Annual Inflation rate 0.7%

- Private sector business investment growth 1.2%

Unfortunately all of these statistics are indications that China’s economy is in bad shape now.

It’s a combination of many factors:

- The birthrate has fallen to a point where the population is now decreasing.

- The recovery from Covid has been much slower than other countries.

- The business regulatory environment has become extremely harsh.

- Tensions with the US are also hurting business confidence.

None of these problems can be easily solved so it is inevitable that China’s future economic growth will be less than what it was previously

It is possible that our exports to China could continue to increase even while their economy performs poorly but the overall expectation is that mining profits will be less in the future.

US Debt Ceiling fight

This fight seems to have been resolved without too much drama but it will inevitably come around again for the following reasons:

- There is an entrenched resistance to tax increases within the political classes.

- The nature of the US political system results in regular conflict between Congress and the President.

- The cost of Social Security and Medicare will escalate as the population ages.

It’s not possible to eliminate the budget deficit without raising taxes substantially or cutting social security, medicare and Defence. When all four of those things are unquestioned debt will continue to increase.