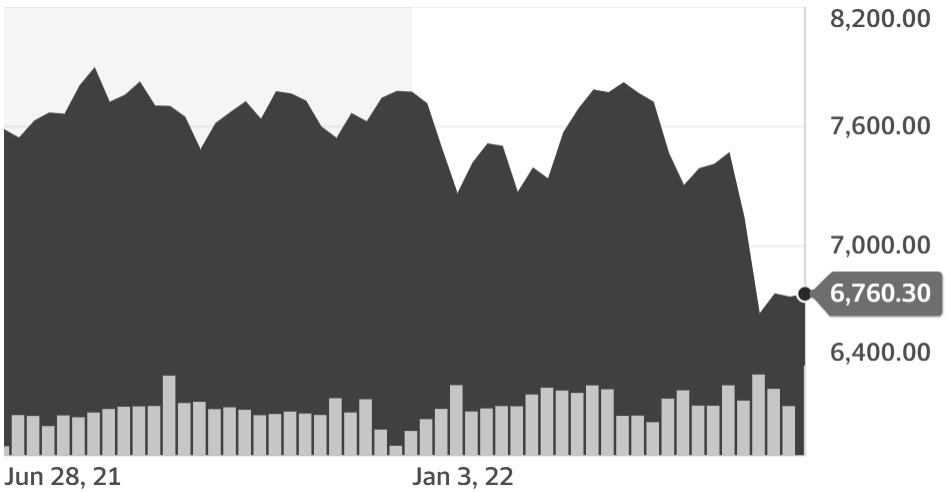

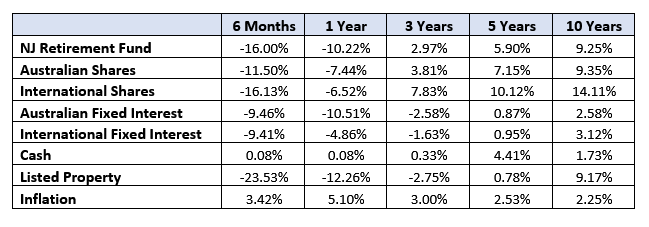

Investment Returns to 30 June

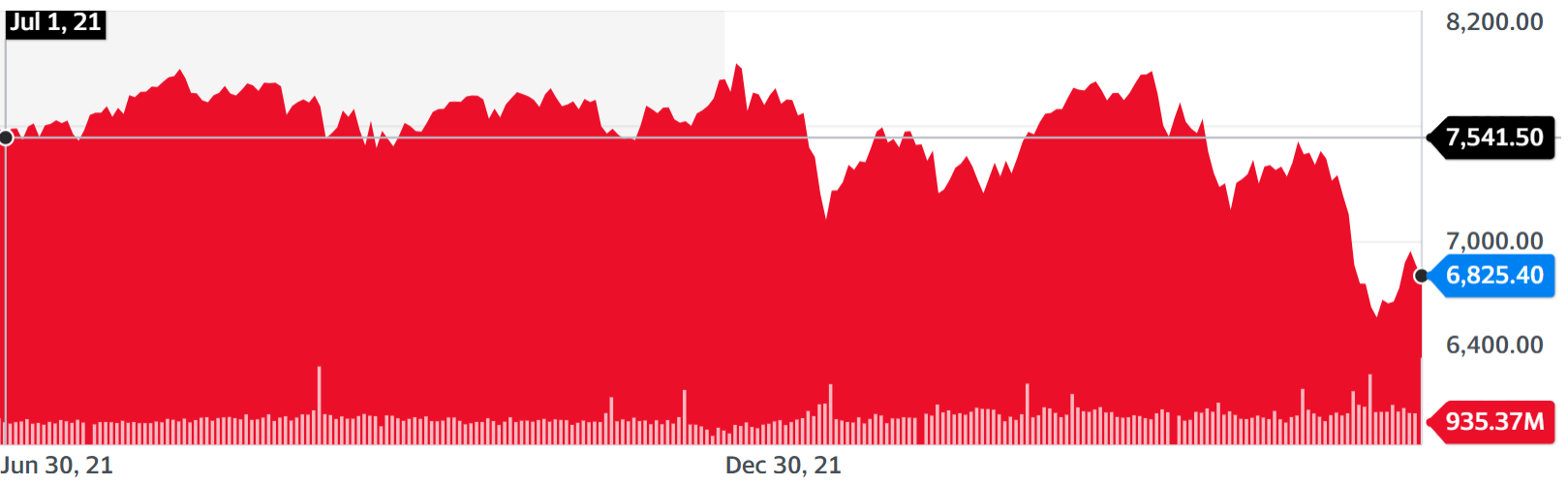

All Ordinaries Index

Market Update

It was a bad quarter for all investment markets.

The share market and bond market both fell sharply in May when the Reserve Bank of Australia (RBA) started increasing the official interest rate. Increases in rates by themselves cause financial models to show lower valuations for share investments and directly lead to a de-valuation of fixed interest rate bonds.

Increases in rates also stoked fears of recession due to loss of consumer confidence and reduced consumer spending. However if there is a recession then this would eventually lead to lower interest rates in the future so nothing is simple.

Economic Update

The big news this quarter is that the RBA increased the official interest rate twice by 0.25% in May and 0.5% in June. This signalled that the era of low interest rates is over for now. Previously the RBA had indicated that they would hold the rate down for a period of 5 years. They has also been engaged in quantitative easing to ensure that the 3 year year fixed rate would stay low.

The reason for doing this is that the CPI has now gone up to 5.1% which is well above the RBA target range 2-3%. This is a similar experience globally with the US & UK also experiencing similar increases in inflation. The RBA has stated that they expect inflation to hit 7% by the end of the year.

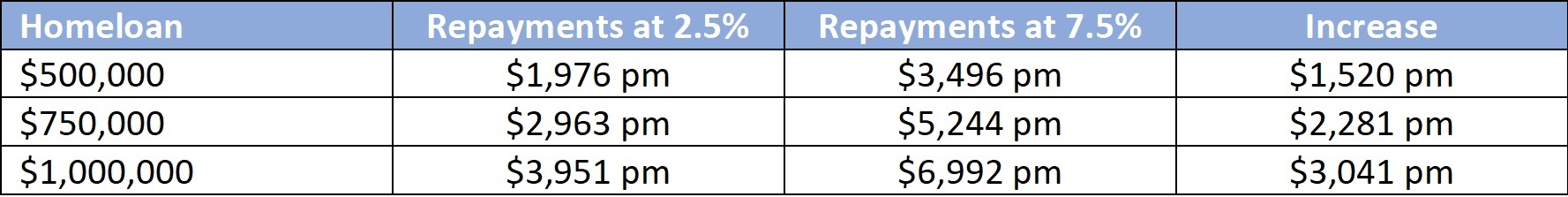

Some economists have predicted that this will cause the RBA to increase the official interest rate to 5%. This will push variable mortgage rates up to around 7.5%.

If interest rates go up by this much it will have a massive impact on home loan repayments:

Increases of that magnitude are not sustainable and will lead to significant hardship to people caught in that position. Past experience has shown that mortgagees will cut back on everything else before they consider selling their house. Businesses that rely on discretionary expenditure will suffer while house price falls will probably be relatively small.

Home buyers will likely find that their borrowing capacity is greatly reduced.

A more optimistic view has been put by Paul Krugman in the New York Times questioning if the era of cheap money is over.

His argument is:

1. This inflation outbreak has been caused by:

• The war in Ukraine impacting on commodity prices.

• Covid restrictions in China resulting in Supply chain shocks.

• Flow through of massive government stimulus programs during 2020/21.

• Increases in consumption after the removal of Covid restrictions.

These are temporary situations that will resolve to some degree within a relatively short time period.

2. Interest rates were trending down over the last 30 years for the following reasons:

• Demographic changes due to low birthrates in the largest & most developed economies.

• A savings glut amongst the wealthiest citizens.

• A lack of productive new investment opportunities (as opposed to buying existing assets).

Based on these factors he believes it is likely that inflation will go back down to the 2-3% level in around 18 months time.

One of the reasons for this is that farmers have responded to higher grain prices by planting much larger crops. In six months time those crops will be ready and the grain supply will greatly increase. That will inevitably lead to lower prices for grains.

Superannuation changes

The Superannuation Guarantee rate increased from 10% to 10.5% on 1 July.

It is now programmed to increase by 0.5% each year for the next 3 years until it reaches 12%.

The tax deductible contribution limit will remain the same at $27,500 so it might be necessary to review and adjust any salary sacrifice arrangements to ensure that you remain below the limit.

China Trade Relations

With the election of the new Albanese led ALP government an opportunity to reset relations with China has been presented.

It started when the new Defence minister Richard Marles met with his Chinese counterpart at the Shangri-La Dialogue in Singapore on 13 June. This was the first meeting of ministers since 2019. It occurred shortly after a Chinese Jet Fighter engaged in a dangerous interception of a Royal Australian Air Force Surveillance plane that took off from the Philippines and flew over a contested area of the South China Sea.

Prime Minister Albanese has called for the Chinese government to remove trade sanctions on Australian Barley, Coal, Seafood, Wine and other products before they will make any moves to repair the relationship. Those sanctions were imposed after former Prime Minister Scott Morrison called for an independent inquiry into the origins of the Covid-19 virus.

The Chinese Ambassador gave a speech at the UTS on 24 June. When asked about the trade sanctions he gave contradictory answers. Firstly stating that the trade sanctions were a spontaneous reaction by ordinary people and were not at the hands of the government. He then subsequently claimed that they were anti-dumping measures.

The first claim is nonsense as the Chinese Government is a dictatorship in full control of trade policies and need not give any regard to public opinion. Given that all of the sanctioned items are either globally traded commodities with prices set by the market or premium products (wine & seafood) that sell at high prices, the accusation of dumping is also clearly false as that normally applies to manufactured items like concrete and steel.

So it seems likely that this trade dispute will not be resolved any time soon and could get worse.

Any escalation of this trade dispute is likely to hurt our Mining sector. In our model portfolios we have reduced exposure to the two largest mining companies BHP & Rio Tinto.