Retirement shouldn’t hang over anyone’s head as a frightening prospect. The current gender gap statistics that show women retire with 47% less in their superannuation balance compared to men are especially worrying. With the benefits of time and compounding, the earlier you start, the easier it is to retire with a healthy balance. Let me take you through a case study to show how small changes can greatly improve your superannuation balance at retirement.

Superannuation Advice Case Study

Client: Single Female aged 39.

Owns her home, worth $600,000 with $450,000 mortgage on 2.79% interest and repayments of $2,085 per month.

Current salary: $100,000 ($6,160 per month after tax). Super contribution $9,500 per year.

Regular living expenses: $3,500 per month and regular savings $575 per month.

Current Super balance: $70,000.

Question: What can I do to maximise my position at retirement?

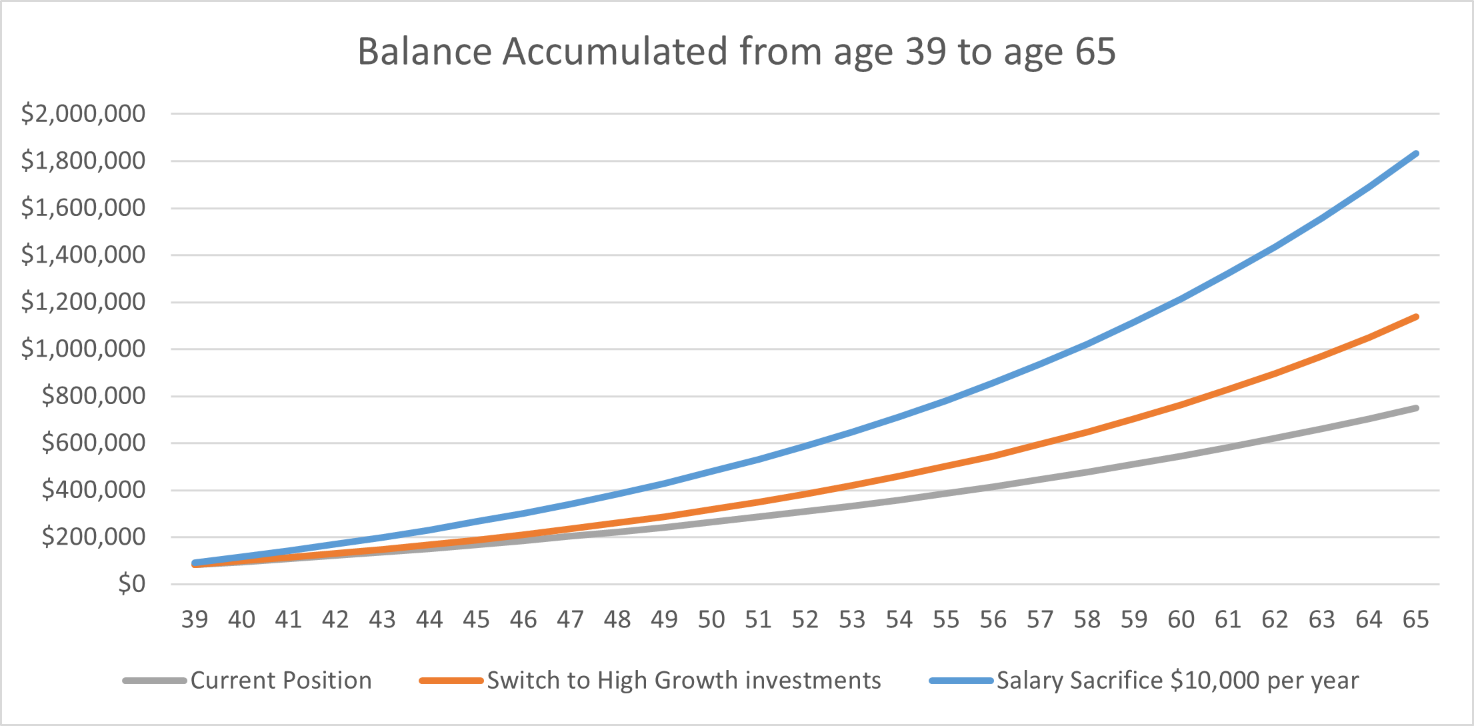

Current projection:

- Mortgage will clear in around 25 years. If the plan is to retire at 65 or older then it is not necessary to increase payments now.

- Super based on a ‘Balanced’ investment profile with an estimated after-tax return of 5% is projected to have $750,000 at age 65.

Changes you can make:

- Switch the risk allocation to 100% growth assets with a projected return of 7% after tax,

- The balance is projected to be $1,130,000 at age 65 (assuming there is no increase in contributions).

- Start a Salary Sacrifice arrangement adding $10,000/year to Super. This will cost $6,550 after tax ($545.83 per month).

- Projection reaches $1,830,000 at age 65. That is an increase of $700,000.

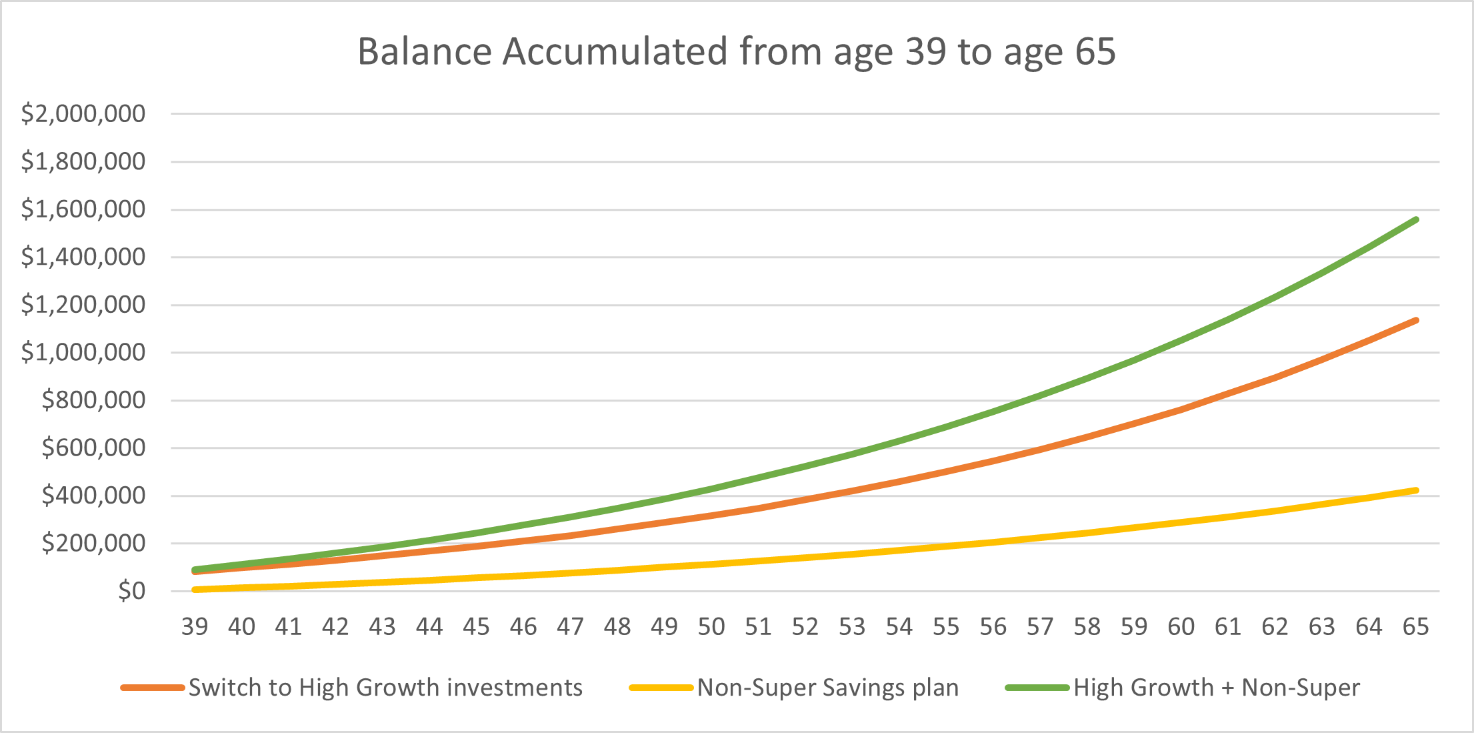

What is the next best alternative?

If you don’t want to lock up your money until retirement age, the next best alternative is to save money into shares directly.

After 26 years, total contributions are $170,300 and the net balance is $420,000 with approximately $170,000 of unrealised capital gains and $80,000 of reinvested after-tax income.

The end result is significantly less due to the higher income tax rate placed on earnings outside of the superannuation environment.

Conclusion

Shifting to a high growth investment profile can increase your expected returns in the long term, but you need to be prepared to accept the short-term losses and there is no guarantee that the return will be higher than a government bond over any given period.

Salary sacrificed superannuation contributions can turbo-charge the growth of your fund. It works because the super fund tax rate is much lower than the personal tax rate (eg 15% versus 34.5%).