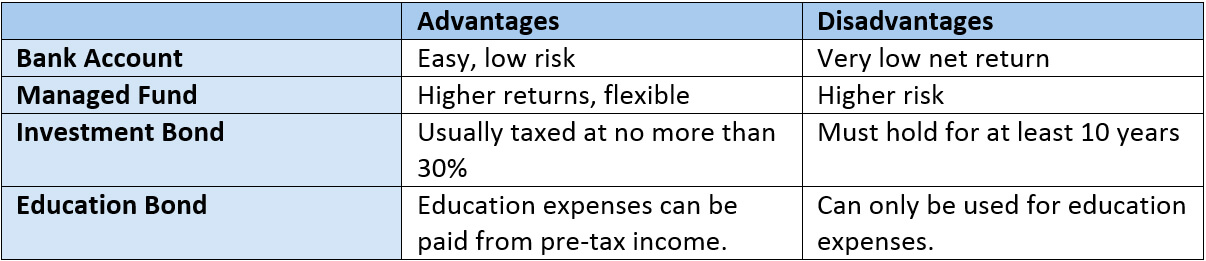

There are 4 basic options:

- Save into a bank account

- Contribute to a managed fund

- Purchase an investment bond

- Start an education bond.

See https://www.moneysmart.gov.au/managing-your-money/saving/saving-for-your-childrens-education

Which option is best for you?

That depends on the age of your children, the amount of money you wish to invest, the level of risk you are willing to accept and the final purpose of the money.

Another issue to consider is how these contributions will affect your other goals and what will you do if you have cashflow problems in the future?

The important things to remember are to:

- Start early.

- Make regular contributions.

- Ensure that you are getting a reasonable return for the time period you invest.

- Have flexibility for unforeseen circumstances.

We can help you to make a plan that fits within your other financial arrangements and gets the best possible result for your children.