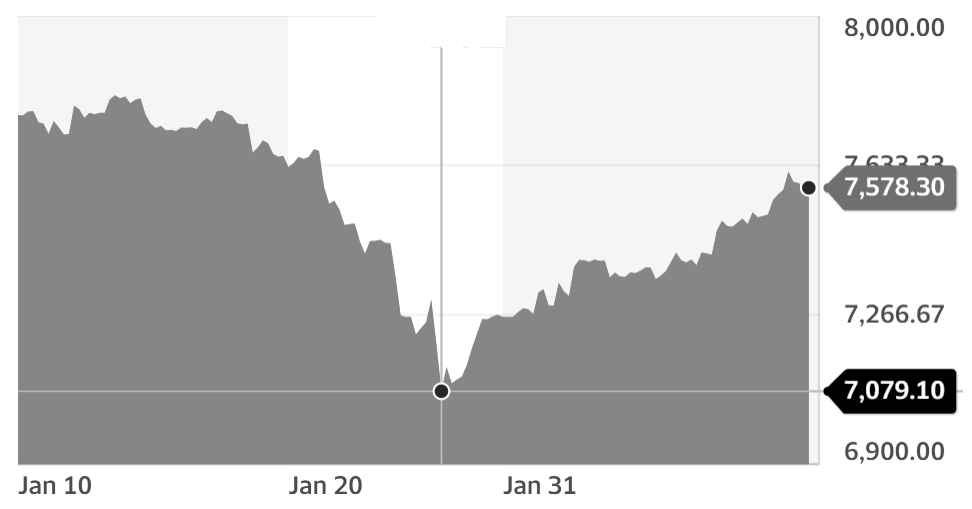

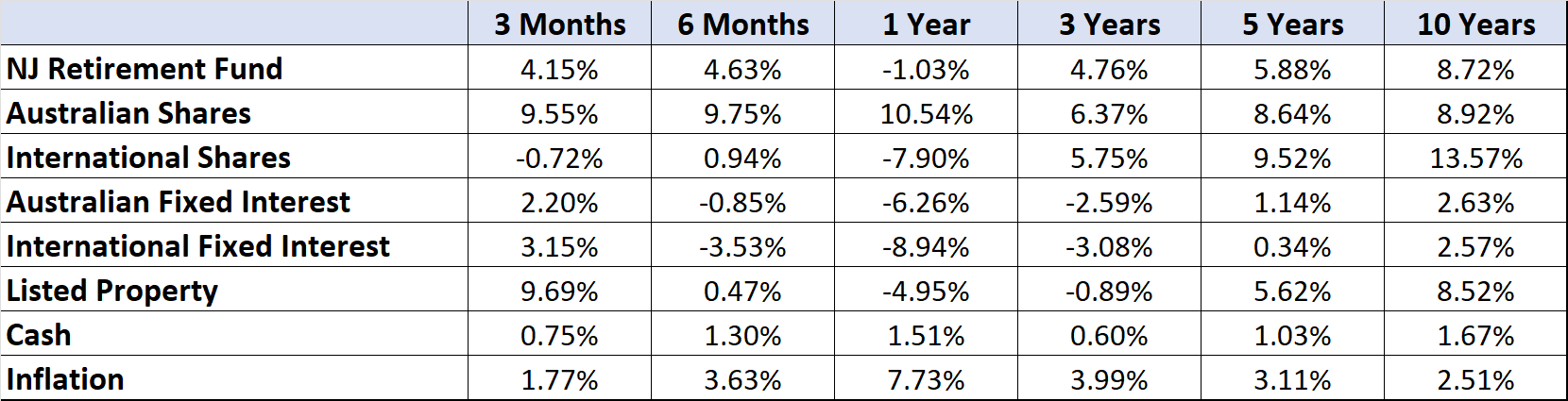

Market returns to 31 January 2023

All Ordinaries Index

Market Update

The market has risen strongly over the last 4 months and is now back to where it was in April last year.

The reasons for the improvement are expectations that:

- The Chinese economy will recover now that they have removed Covid restrictions.

- The rate of inflation will reduce this year.

- The Reserve Bank of Australia will stop increasing interest rates soon.

This will result in a soft landing rather than a severe economic downturn and help large companies to remain profitable.

Economic Update

The Reserve bank has now increased the official interest rate to 3.35%. This is the highest level in 10 years and has caused mortgage rates and repayments to more than double for most borrowers.

The problem is that the key economic statistics are all showing a booming economy:

|

Most recent quarter |

12 months |

|

| CPI inflation rate |

1.77% |

7.73% |

| GDP economic growth |

0.6% |

5.9% |

| Unemployment rate |

3.4% |

5.3% |

The large interest rate increases will cause a reduction in consumption and business investment in the next 12-18 months. So it is inevitable that the unemployment rate will go back above 5% at some point.

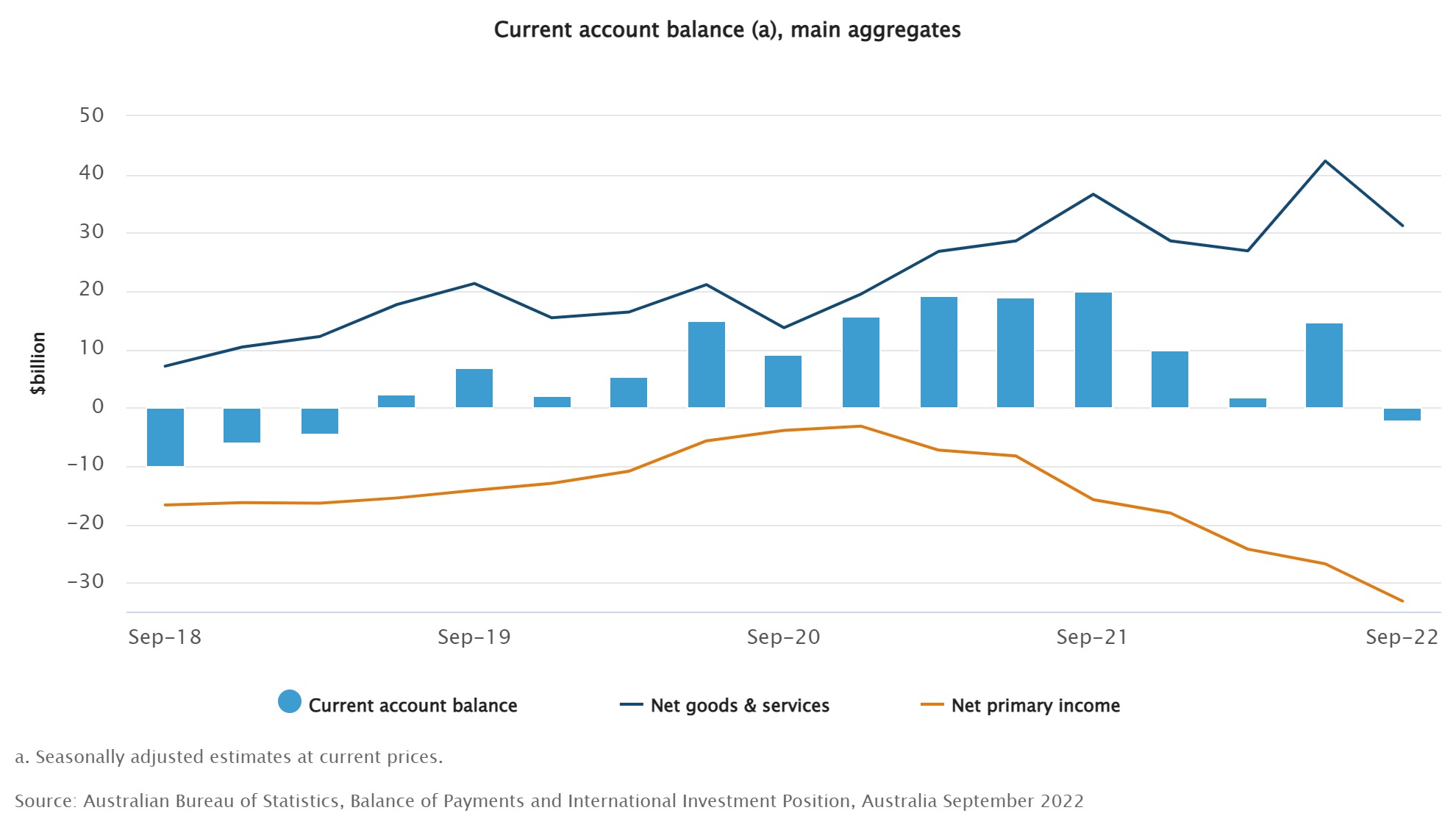

In addition to this the Current Account Balance has been in a surplus for more than 3 years. This is extraordinary as it had been consistently in deficit for the previous 40 years.

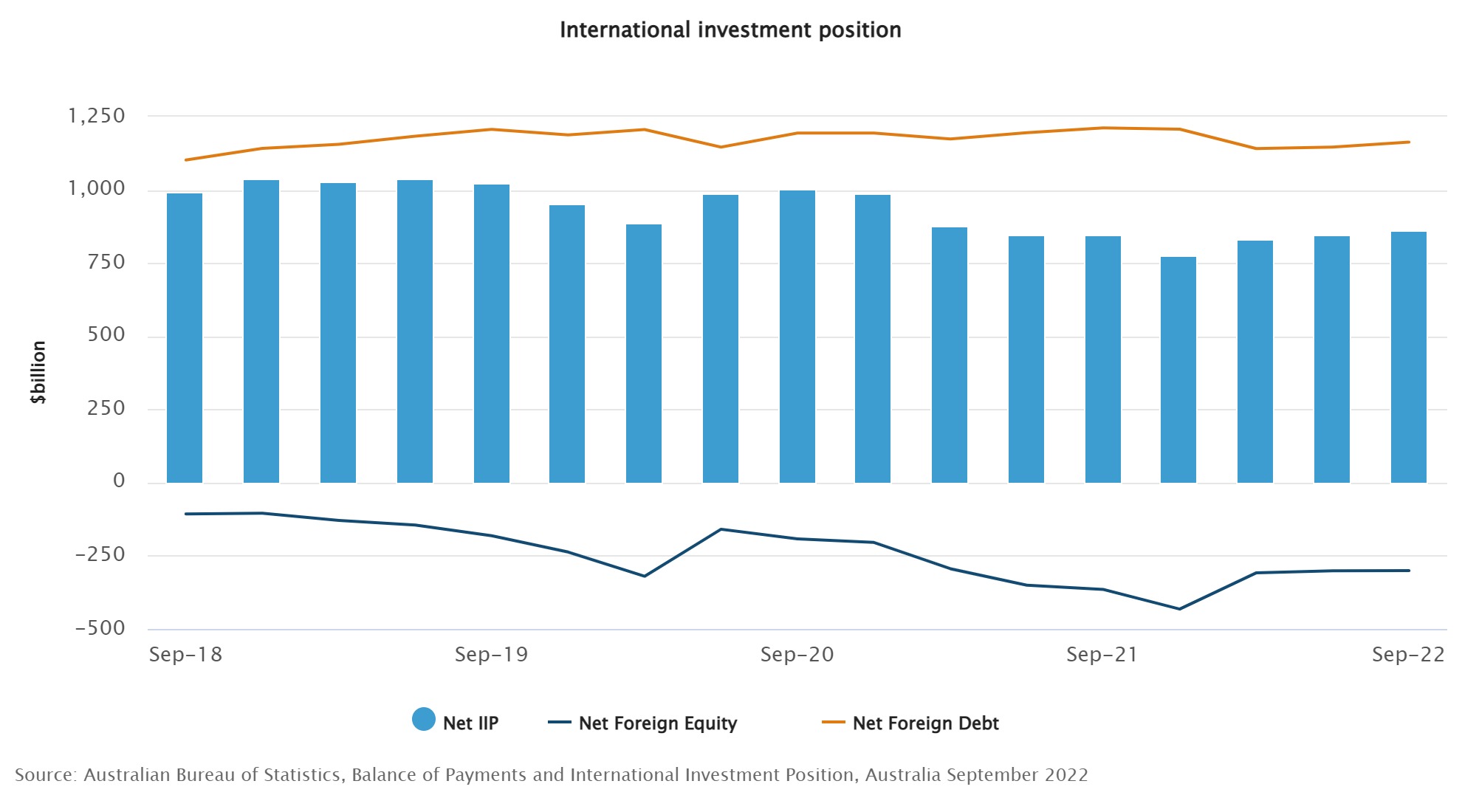

This means that despite the government debt increasing significantly during Covid, we as a nation have started to reduce our foreign debt:

Overall the economy is in very good shape which is why the Reserve Bank has not hesitated to increase interest rates despite the harm this causes to heavily indebted individuals.

Central banks in most of our trading partners have increased interest rates by similar amounts. If we don’t follow them then our exchange rate will fall and the cost of imported goods will increase thereby making our inflation rate worse.

Crypto meltdown

Six years ago Bitcoin was trading at $500 per coin. It hit a high point of almost $88,000 in November last year. Since then it has lost 70% of its value. Investors who bought in more than 2 years ago have still made a nice profit but the future expectation is a negative return.

This is a classic investment bubble similar to everything from Tulip bulbs to Dotcom shares. Bitcoin has no intrinsic value or use so other than hacking ransoms it is purely a tool for speculation.

FTX bankrupt

Crypto exchanges have suffered even bigger falls than Bitcoin with the highest profile collapse being FTX. Founded in May 2019 FTX attracted significant institutional investment and was valued at US$32 billion in January this year. It was the third largest crypto exchange in the world.

There are Ponzi schemers who are intentionally fraudulent right from the beginning such as Bernie Madoff and Melissa Caddick then there are those that stumble into it when they wake up one day and realise that their business proposition is completely unrealistic. FTX probably falls into the latter category.

Their initial pitch to investors is that they would borrow money from customers at 15% interest and invest that money into Crypto assets that were presumed to be generating a higher return than that and pocket the difference as their profits.

When they realised that this was not going to work 12-18 months ago they should have shut the company down but instead of doing that they continued to operate and effectively became a Ponzi scheme. Like all of their predecessors the scheme inevitably collapsed as soon as customers started trying to withdraw their money.

Superannuation Update

The age limit for non-concessional contributions of up to $330,000 is now 75 regardless of employment status.

The minimum age for Downsizer Contributions is now 55 with a lifetime limit of $300,000.

The Transfer Balance Cap is currently $1.7m and is expected to be increased to $1.8m on 1 July with CPI indexation.