Written and accurate as at: 12 Jul 2019

With the ushering in of a new financial year, certain rates and thresholds have increased, and several legislative instruments have taken effect. These may impact your personal finances moving forward.

Given this, in this article we will focus on the state of play from 1 July 2019. More specifically, regarding the numerous changes that have taken place within three key personal finance areas – employment, superannuation and personal income tax.

Employment

Study and training loan repayment

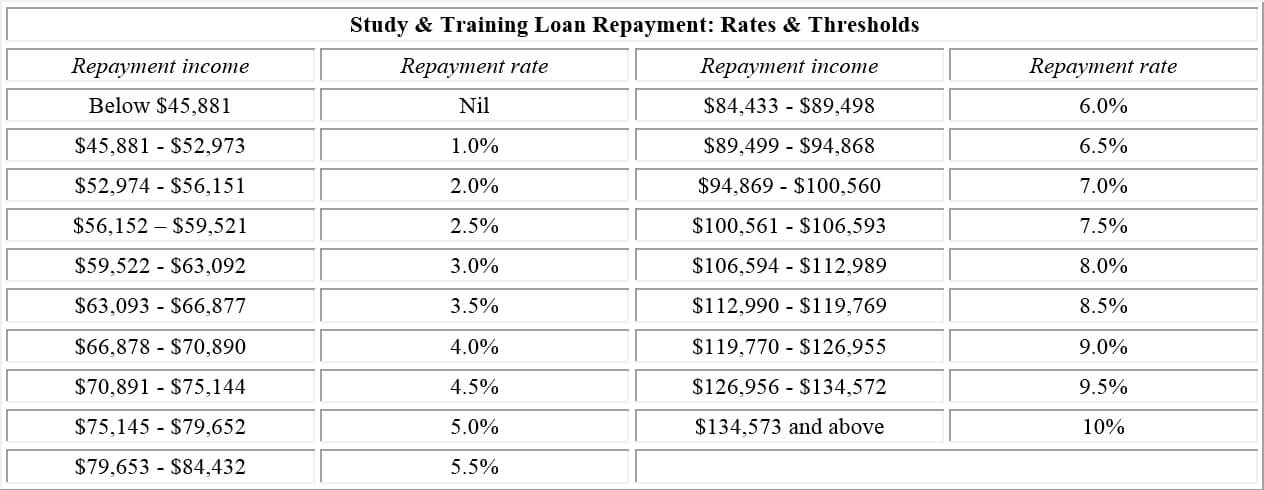

As of 1 July 2019, there are new study and training loan repayment rates and thresholds. The new rates and thresholds are contained within the below table.

The new rates and thresholds pertain to the following study and training loans:

- Higher Education Loan Program (HELP),

- VET Student Loan (VSL),

- Student Financial Supplement Scheme (SFSS),

- Student Start-up Loan (SSL),

- ABSTUDY Student Start-up Loan (ABSTUDY SSL),

- Trade Support Loan (TSL).

Superannuation

Anti-detriment payments

As at 1 July 2019, super anti-detriment payments are no longer available.

It’s important to note that super funds were still able to make super anti-detriment payments until 30 June 2019 for those members who passed away before 1 July 2017.

For context, if a super death benefit was paid out to an eligible dependant as a lump sum payment, then in some cases an additional payment benefit payment may also have been paid.

This additional payment was referred to as a super anti-detriment benefit payment and represented a refund of the 15% contributions tax paid by the deceased person during their lifetime.

Carry forward provision

The carry forward provision, which came into effect from 1 July 2018, allows you to carry forward unused concessional contributions cap amounts on a rolling basis for a period of up to 5 years.

Given above, this is the first year that you may be able to make additional catch-up concessional contributions using unused concessional contribution cap amounts from ‘previous years’ (2018-19).

Please see here for more information regarding the relevant eligibility requirements.

Maximum superannuation contribution base

Compulsory private savings via Super Guarantee forms a part of the Government’s three-pillar approach regarding the sustainability of Australia’s retirement income system (in the context of an ageing society).

The Super Guarantee contribution rate is currently 9.5% of your earnings up to a certain limit for each quarter of a financial year. This limit is called the maximum superannuation contribution base (MSCB).

As of 1 July 2019, the MSCB has increased to $55,270 per quarter, which works out to be $5,250.65 Super Guarantee per quarter ($21,002.60 Super Guarantee annualised).

Personal Income Tax

The Treasury Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money) Bill 2019 has passed through parliament. In a nutshell:

- The low and middle income tax offset (LMITO) has increased from a maximum amount of $530 to $1,080 per annum, and the base amount has increased from $200 to $255 per annum for the 2018-19, 2019-20, 2020-21 and 2021-22 financial years. This is what it looks like for taxpayers with the following taxable incomes:

- ≤$37,000, $255

- from $37,001 to $48,000, $255 plus 7.5 cents per dollar above $37,000

- from $48,001 to $90,000, $1,080

- from $90,001 to $126,000, $1,080 minus 3 cents per dollar above $90,000

- From 1 July 2022:

- instead of increasing from $37,000 to $41,000, the top threshold of the 19% personal income tax bracket will increase to $45,000

- the low income tax offset (LITO) will increase from $645 to $700 (and decrease at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000, and decrease at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667)

- From 1 July 2024-25, the 32.5% personal income tax bracket will reduce to 30%. This is what it will look like for taxpayers with the following taxable incomes:

- ≤$18,200, nil tax

- from $18,201 to $45,000, nil plus 19% for each dollar over $18,200

- from $45,001 to $200,000, $5,092 plus 30% for each dollar over $45,000

- $200,001+, $51,591 plus 45% for each dollar over $200,000

Other important announcements

Loan serviceability assessments

The Australian Prudential Regulation Authority (APRA) have advised that they are proceeding with revisions to their guidance on the serviceability assessments that authorised deposit-taking institutions (ADIs) perform on residential mortgage loan applications. In a nutshell, taking effect immediately, ADIs will be able to review and set their own minimum interest rate floor for use in serviceability assessments and utilise a revised interest rate buffer of at least 2.5% over the loan’s interest rate.

If you have any questions regarding this article, please do not hesitate to contact us.