Why do Investors often buy high and sell low?

This is the opposite of a winning investment strategy but investors often give considerable attention to short term performance figures when making investment decisions.

It could be a result of the ‘recency effect’

You probably know that many of our financial decisions aren’t made rationally: emotions and biases play a major role in how we spend, save and think about our money.

But did you know that for most people, the number one bias is the ‘recency effect’. This is the tendency to be easily influenced by the latest, events, experiences or news headlines.

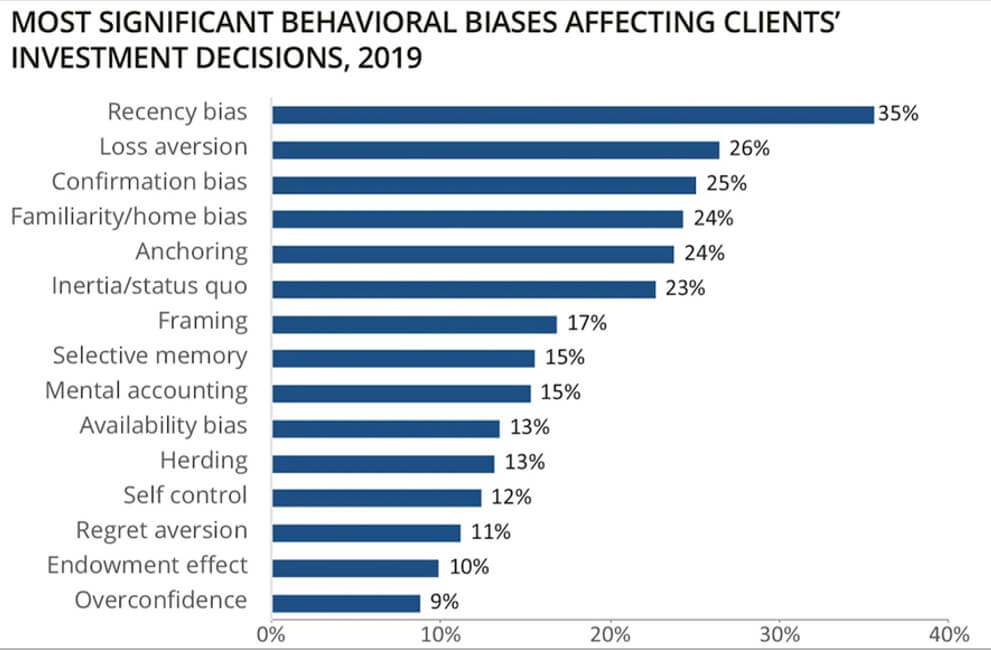

The study, conducted by the US firms Charles Schwab Investment Management and Cerulli Associates, took a look at the behavioural biases that all investors grapple with when making decisions about their money.

We share the key learnings with you here.

What is the ‘recency effect’?

To illustrate, let’s take a simple everyday example. Let’s say you’re driving in an overseas country for the first time. On your journey you see an equal number of black cars and white cars but in the last hour of your trip, just about all the cars are black.

Studies suggest you’re more likely to think that there are more black cars than white cars on the road and the locals must prefer black cars.

Now of course, unless you’re planning on manufacturing cars, getting the colour of people’s car preferences wrong should have no consequences for you.

However, when it comes to investing, recency bias can be very costly indeed.

It can skew your view of how the future might play out.

What goes up can go down (and vice versa)

When investors overweight the importance of recent or memorable events, they are more likely to performance chase rather than make strategic investments that could be more appropriate.

Simply expecting future results to be a continuation of recent market trends often leads to irrational decision making.

Recency bias can cause clients to buy and sell investments at the worst possible times (such as buying high and selling low).

For example, if the market has been rising strongly, it is common for investors to assume it will keep rising. They can easily be lured into buying more of the high-performing assets, instead of rebalancing their portfolio which could mean selling some of their recent winners.

The years leading up to the peak of markets in 2008 was a classic example of this behaviour. And while there were several boom years with shares returning more than 20% a year, many of those who were overweight risky assets experienced devastating losses when the global financial crisis hit.

On the flip side, an investor might see a fall in markets as a sign that share prices will continue downward.

Again, going back to the 2008 global financial crisis, reports of the sharp falls in share markets dominated the headlines on a daily basis – no wonder for many investors that despair set in.

Even when share prices had fallen considerably, many investors assumed the downward trend would continue and took shelter by selling.

But just like the markets have always done (sometimes it takes longer than others), they eventually settled and in March 2009 resumed their upward path. Those who had sold at the bottom probably locked in losses from which it would be very hard to recover.

What can you do?

Having an adviser as an objective guide is a great start.

While we may not be able to completely offset an individual’s inevitable human biases, there are three key things we can do to reduce the negative impact that these biases can have on investment outcomes.

Long-Term View: Maintaining a long term view, particularly in periods when the market is most volatile. As part of this, you will hear us remind you that what matters most is your personal goals – not market fluctuations. And by working with you to develop a clear and comprehensive financial plan, and sticking with it, we can help you reduce emotional reactions and avoid making poor investment decisions.

Systematic Process: This includes things like setting a target risk profile and then ensuring regular rebalancing to stay aligned – even if it means selling your darlings.

Goals-Based Planning: This is about aligning goals and portfolios – for example, allocating money you may need for the short term to defensive assets, and allocating long term funds with a higher weighting to growth assets. We find that this can reduce the chances of an emotional reaction to any sudden market downturns.

Sources: Charles Schwab & Cerulli: The Role of Behavioral Finance in Advising Clients (September 2019).