Sydney and the surrounding area (Blue Mountains, Central Coast & Wollongong) went in to lockdown on Saturday 26 June. This lockdown was scheduled to end at midnight on Friday 9 July and has been extended to 16 July. However given that the number of new cases each day is not reducing it could be extended again.

This is very upsetting for many people who have lost income, are separated from friends & family or have suffered too much disruption to their lifestyle. We had prided ourselves on doing a great job of bringing Covid under control last year but it keeps coming back.

Clearly there is a lot that hasn’t gone to plan including the vaccination program and quarantine arrangements. The messaging around what qualifies as essential activity is very muddled. The level of financial support being provided to people who have lost income due to the lockdown is also sorely lacking. These failures are frustrating as we expected better from our leaders and authorities.

The PM has announced that fully vaccinated people will have less restrictions in future. The best plan of action on a personal level is to do what you can to stay safe and register to be vaccinated at the earliest opportunity.

Covid Safe Plan

All non-residential workplaces will be required to register as COVID Safe and offer Service NSW QR code check-ins to staff and visitors from 12 July. This includes premises that are not open to the general public. Accordingly we are in the process of registering.

Businesses must take reasonable steps to ensure that people entering their premises check-in using the QR code. So you should expect to see this everywhere you go in future.

Updated Financial Services Guide

Due to changes in government regulations we are now required to clearly explain any reasons why our advice is not impartial or independent. The receipt of commissions from Life Insuranc companies is one of those reasons. We have now updated our Financial Services Guide. The latest version can be found here:

https://sfasydney.com.au/wp-content/uploads/2021/07/SFA-FSG-010721-v5.pdf

Investment performance figures

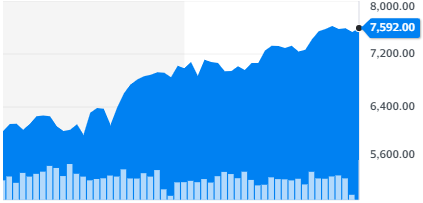

The good news is that unlike last year there has not been any direct financial fallout on the sharemarket yet.

The Australian sharemarket has had one of the best financial year returns ever. This is partly due to recovery from the Covid slump last year but it has now gone well above the high point hit in January last year.

Higher risk investments such as Small companies and Emerging Markets have delivered better returns that the market index. This is normal but the recovery was bigger and quicker than most people expected.

Listed Real Estate has also had a strong recovery during the year despite question marks over the future of office work and retail. Bricks & mortar may be losing the battle against online shopping but there is still money to be made in physical real estate.

Conversely government bonds and other fixed interest investments have had a terrible year and there is now a real question mark about the usefulness of including “low risk” investments in a long term portfolio.

Market Returns:

All Ords Index 12 months to July 2021: