We started the new financial year in optimistic spirits but the second wave in Melbourne has dented it somewhat. Are we doomed to a long period of low returns?

Market Returns to 31 July 2020

| 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | |

| Australian Shares | -13.62% | -9.02% | 5.69% | 5.54% | 7.43% |

| International Shares | -7.06% | 3.42% | 11.61% | 8.11% | 12.35% |

| Australian Fixed Interest | 1.55% | 3.57% | 5.61% | 4.58% | 5.61% |

| International Fixed Interest | 2.77% | 5.54% | 4.96% | 4.72% | 6.00% |

| Listed Property | -25.52% | -22.75% | 2.24% | 3.36% | 9.18% |

| Cash | 0.25% | 0.73% | 1.49% | 1.70% | 2.64% |

Source: Lonsec Research Pty Ltd

Australian Sharemarket

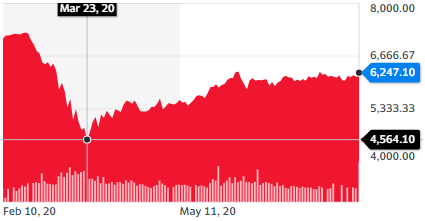

The Australian sharemarket hit rock bottom on 23 March, falling to 4,564.10. There was a rapid recovery over the following 3 months and has been bouncing around a fairly narrow band in the last 1.5 months.

Consumer Price Index (CPI)

The official CPI fell by 1.9% in the June 2020 quarter with the annual CPI falling by 0.3% for the full financial year. However, this includes temporary price reductions resulting from COVID-19 measures such as free childcare. When volatile items are excluded, the CPI was up 0.4% for the year.

See https://rba.gov.au/inflation/measures-cpi.html

Projected Returns

The interest rate payable on 90 day Bank Bills is currently approximately 0.1% per annum. Bank term deposit rates are between 0.2-1.0%.

The Reserve bank has set the official interest rate at 0.25% and is purchasing Australian Government Bonds to achieve a target yield to maturity on 3 year bonds at that level. Federal Government 10 year bonds currently yield 0.87% and NSW State Government 10 year bonds are 1.33%.

To achieve a higher return than that you need to take credit risk, invest in property or equity markets. Low rated corporate bonds are not popular given high profile corporate collapses. Listed real estate markets have been hit hard and there is an expectation that unlisted property valuations will also go down eventually. Residential vacancies are at the highest level in 20 years.

This leaves the sharemarket as the most attractive investment option. That is why it has gone up so much but the problem now is that the current valuation also means that the return going forward is likely to be no more than 5-7% per annum.

If you can achieve your financial goals while earning a return of 5% or less, then this is not a problem.

Unfortunately, there are many investors who need a much higher return than that to achieve all of their financial goals. This leaves them with only unfavourable options:

- Discard or reduce your goals.

- Sacrifice your current lifestyle.

- Invest in speculative assets.

Speculative Options

The range of speculative assets include:

- Cryptocurrencies (e.g. Bitcoin)

- Commodities (e.g. precious metals)

- Unproven companies (e.g. Afterpay)

- Short term highly leveraged trading (e.g. CFDs)

Many of these options have no expected return and can result in the investor unexpectedly losing all of their capital. I have spoken to people who have made $50k in one day trading CFDs and then lost $100k the next day. Ironically, one of the losing trades was shorting Afterpay.

The danger is in thinking that you, as an amateur, can predict the market and make money where most professionals cannot. Any investment strategy that relies on predictions about the future is likely to fail.

What’s the answer?

There is no easy answer.

My thoughts are that you need to be patient and wait for this crisis to pass and be modest about your expectations for returns and your future lifestyle.

I googled “Why do people Gamble?” and there were many reasons listed.

For most, it’s excitement and entertainment. For some, there is a profit motive. They know intellectually that most people lose but they feel that they will be lucky or skilful enough to avoid that fate. They are addicted to the process of gambling or they feel desperate enough to think it’s the only option to escape from financial difficulties There can also be a misperception when gambling small amounts at a time that it is a low-risk, high return proposition when the reality might be that the risk is high and the returns are low.

The short answer is don’t gamble with your life savings.