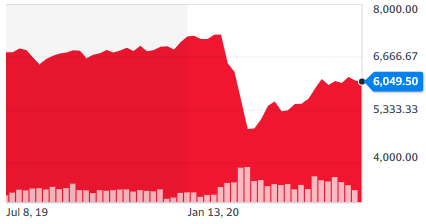

The first 7.5 months of the 2019/2020 financial year were benign with the Australian sharemarket delivering a return of around 6%. Then the Covid-19 crisis hit home and the market fell by 33% in the space of 4 weeks. It has subsequently recovered by 25% to end the year down by 7.2%. This was an unusually short-lived market correction given the magnitude of the crisis we are facing.

Why did the market recover so quickly?

- Fast reaction by Governments to provide financial support to businesses and individuals.

- The US Federal Reserve pumped money into financial markets.

- In Australia and many other countries the spread of the virus was curtailed.

- There is optimism that business will go back to ‘normal’ in the relatively near future.

This recovery might not last and there will be big falls in the market in the future. However the lesson here is that you don’t need to predict the market to be a successful investor.

Some of the key strategies that help are:

- Risk Profiling

- Diversified Asset Allocation

- Regular contributions

- Regular re-balancing

The sharemarket has been significantly more volatile than normal over the last 5 months, which has over-whelmed the ability of investors to respond. Despite this we are staying calm and trying our best to help everyone get through it.

Market returns to 30 June 2020

| 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | |

| Australian Shares | -10.42% | -7.21% | 5.43% | 6.22% | 7.78% |

| International Shares | -3.60% | 5.18% | 10.76% | 9.37% | 12.36% |

| Australian Fixed Interest | 3.53% | 4.18% | 5.57% | 4.77% | 5.60% |

| International Fixed Interest | 4.14% | 5.31% | 4.91% | 4.85% | 5.96% |

| Listed Property | -21.29% | -21.33% | 2.00% | 4.38% | 9.22% |

| Cash | 0.32% | 0.85% | 1.53% | 1.73% | 2.68% |

Federal Budget

The federal government has postponed the 2020/21 budget announcement to 6 October. The Federal Treasurer has advised that he will provide an update on the economic and fiscal outlook on 23 July. It is likely to be a very confronting presentation.

Delaying the budget limits the range of changes that can be made this financial year. The budget is likely therefore to be mainly focused on spending measures such as Jobkeeper & Jobseeker. Those measures are currently planned to finish by the end of September.

The next Federal election is not due until May 2022 but given the result in the Eden-Monaro by-election the government will be under huge pressure to do everything they can to improve the economy.

There was a suggestion that tax cuts scheduled for the 2022/23 financial year could be brought forward. The problem is that even if they are brought forward the cuts will be too small and too late to help get us out of this crisis.

Another suggestion is for infrastructure spending. The problem with that is there isn’t any new infrastructure that could be developed soon enough and actually be utilised suficiently to be worthwhile. The NBN cost $51 billion but only created 25,000 jobs, most of which were temporary. Jobkeeper is significantly more effective at maintaining employment. Many other forms of infrastructure are currently losing huge amounts of money (eg airports, public transport etc).

Market Outlook

The economy will not stabilise until the Covid-19 pandemic has been completely eliminated. Attempts at re-opening the economy without bringing the virus under control are likely to fail. California is now going back into lockdown after prematurely re-opening.

Eliminating community transmission is still no guarantee. Melbourne is also going back into lockdown after quarantine lapses caused a new outbreak. Unless there is a complete shutdown of travel, new cases will arrive from countries that haven’t got the virus under control.

Great progress is being made on development of a vaccine. Human trials have begun on 12 different vaccines. It’s possible that a vaccine could become available in less than a year. However, a vaccine has never been developed for this type of virus before.

The SARS virus ceased infecting new patients before a safe vaccine was found. The main differences between SARS and the Covid-19 virus is that patients with SARS exhibited symptoms in 2-3 days rather than 14 days. This made it much easier to isolate patients before the virus spread. Also while Covid-19 is less deadly than SARS it is more contagious.

Lockdowns and travel restrictions are the most effective defences against Covid-19 right now. Unfortunately those restrictions are having a big impact on the economy and social well-being. Tourism, entertainment and hospitality industries have suffered enormously. They will not recover quickly and many businesses will fail without government support.

The sharemarket remains relatively buoyant because interest rates are at rock bottom. Most investors are preferring to take a risk in the hope of generating 6-7% return than a guaranteed 1-2%. Shares are a long term commitment and if you stick to a disciplined strategy for 10+ years it is almost certain that the returns will justify that risk.